Table of Contents

- Key Takeaways

- What is CBAM

- Did you know?

- According to a study, the estimate of European welfare gain from CBAM is at $47 billion USD.

- Why do we Need EU CBAM Regulations?

- Step-by-Step Guide to the EU CBAM Reporting Process

- Registering with EU Authorities

- Document Emissions

- Engage With Suppliers

- Apply for AEO Authorization

- Use Estimated Values

- Submit CBAM Reports

- CBAM Scope

- Who Needs to Be an Authorised CBAM Declarant?

- Fact Check

- Reporting Requirements for CBAM

- Penalties for Non-Compliance of CBAM Regulations

- Financial Implications of CBAM Reporting for Businesses

- Understanding the Cost of Non-Compliance

- Budgeting for CBAM Reporting Software

- The Long-term Benefits of Accurate CBAM Reporting

- Challenges While Implementing CBAM

- List of CBAM Goods

- Role of CBAM Software in Streamlining Reporting

- How to Choose the Best CBAM Software

- CBAM Policies and Laws

- CBAM Timeline: What do I have to do Now?

- Transitional Period

- Definitive Period- Incremental Rollout

- Definitive Period - Full Implementation

- Wrapping Up

- Frequently Asked Questions

- 1. What is the main purpose of CBAM?

- 2. How does CBAM reporting differ from traditional carbon reporting?

- 3. What penalties can my business face for failing to comply with CBAM?

- 4. How can Mavarick's CBAM software help with compliance?

- 5. Which industries are most affected by the 2024 CBAM regulations?

The European Union's (EU) Carbon Border Adjustment Mechanism (CBAM) is reshaping the landscape of international trade and sustainability. Adopted on May 17, 2023, with its transitional phase starting on October 1, 2023, the CBAM is more than just a new regulation. It’s a pivotal part of the EU’s ambitious climate neutrality plan, which aims for full implementation by 2050.

At its core, CBAM seeks to curb carbon emissions by placing a price on the carbon embedded in carbon-intensive goods imported into the EU, such as steel, cement, and aluminium. By aligning trade practices with the EU’s climate goals, the CBAM levels the playing field between European manufacturers who adhere to strict emissions standards and foreign competitors from regions with looser climate policies.

For businesses exporting to the EU, understanding and complying with CBAM regulations is crucial to maintaining market access and avoiding significant financial penalties.

This blog focuses on understanding the EU’s Carbon Border Adjustment Mechanism (CBAM) and its impact on businesses exporting to the EU. It covers the reporting process, compliance challenges, and how CBAM software can simplify and optimise compliance efforts.

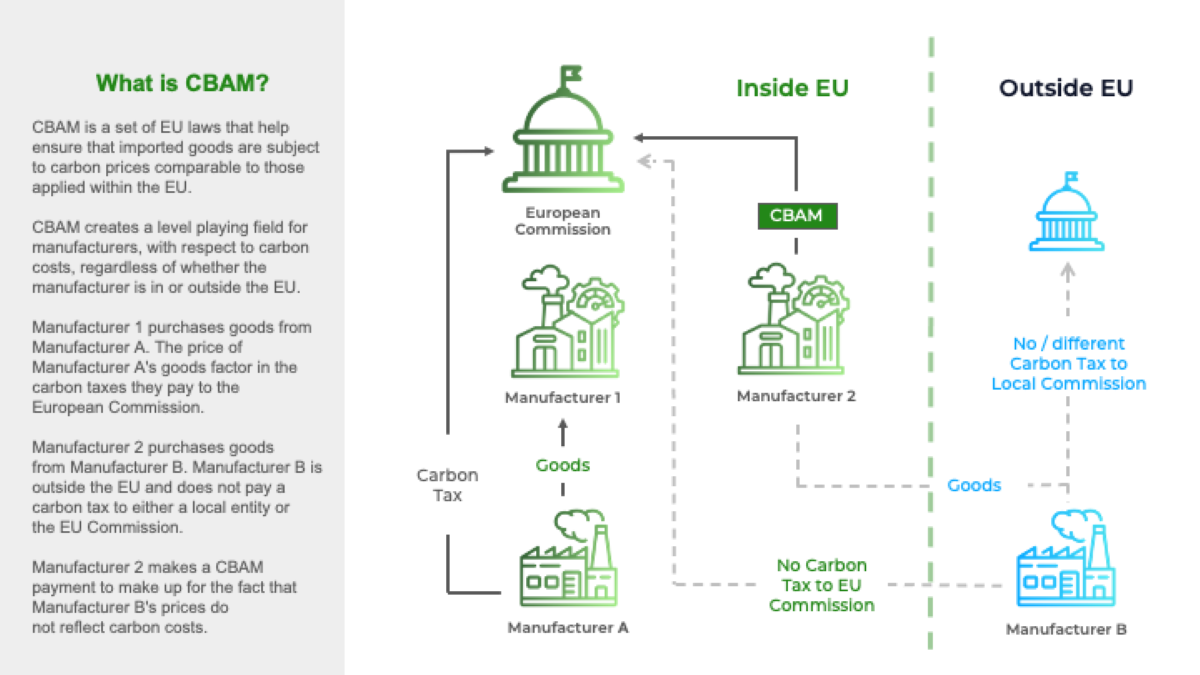

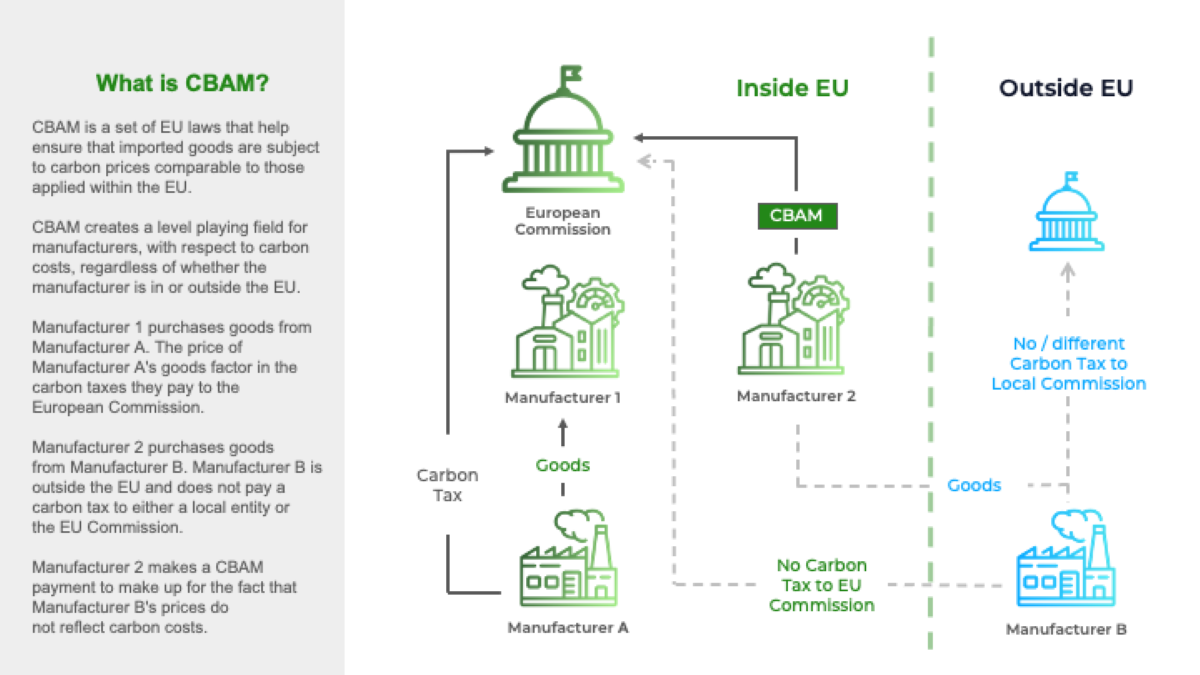

The European Commission wants to make sure that EU manufacturers are not disadvantaged in the marketplace due to the burdens of tracking, reporting & paying taxes on carbon.

CBAM helps ensure a level playing field – by requiring that importers pay a carbon price for goods manufactured in non-EU countries, if those goods don’t face carbon taxes in their country of origin, or in the case they do but they are are more favourable.

If non-EU goods don’t face carbon pricing in their country of origin, they will likely be cheaper than those produced in the EU. Requiring EU importers to make CBAM payments brings the total price of non-EU goods closer with those produced inside the EU.

Let's learn more about the intricacies of CBAM below.

The European Commission wants to make sure that EU manufacturers are not disadvantaged in the marketplace due to the burdens of tracking, reporting & paying taxes on carbon.

CBAM helps ensure a level playing field – by requiring that importers pay a carbon price for goods manufactured in non-EU countries, if those goods don’t face carbon taxes in their country of origin, or in the case they do but they are are more favourable.

If non-EU goods don’t face carbon pricing in their country of origin, they will likely be cheaper than those produced in the EU. Requiring EU importers to make CBAM payments brings the total price of non-EU goods closer with those produced inside the EU.

Let's learn more about the intricacies of CBAM below.

Key Takeaways

- Understand the CBAM's role in reducing carbon emissions and the EU’s climate neutrality goals by 2050

- Know how CBAM affects exporters to the EU and the importance of compliance

- Learn the step-by-step process of registration, carbon calculation, and reporting

- Discover how software likeMavarick simplifies reporting and compliance

- Understand the financial risks and market impacts of failing to comply

- Explore how CBAM compliance boosts sustainability and competitive positioning

- Uncover the key features of software for effortless compliance

- Find answers to common questions about CBAM regulations and software

What is CBAM

The Carbon Border Adjustment Mechanism (CBAM) is a set of EU laws that help ensure that all manufacturers consider the environmental costs of carbon emissions in their pricing – regardless of whether the manufacturer is inside or outside the EU. So what does it include? As part of the EU Green Deal, CBAM seeks to put a price on the carbon emissions associated with producing certain imported goods, ensuring that the EU's ambitious climate targets remain effective. By placing this carbon price on imports, the mechanism discourages companies from shifting their production to countries with less stringent climate policies—a phenomenon known as "carbon leakage." For industries and companies, understanding CBAM reporting and the role of CBAM software is critical to navigating this new landscape and ensuring compliance. Yet, CBAM isn't just about meeting new regulatory demands—it presents an opportunity for businesses to position themselves as leaders in sustainability, leveraging compliance as a competitive advantage in a market that increasingly values transparency and environmental responsibility. The European Commission wants to make sure that EU manufacturers are not disadvantaged in the marketplace due to the burdens of tracking, reporting & paying taxes on carbon.

CBAM helps ensure a level playing field – by requiring that importers pay a carbon price for goods manufactured in non-EU countries, if those goods don’t face carbon taxes in their country of origin, or in the case they do but they are are more favourable.

If non-EU goods don’t face carbon pricing in their country of origin, they will likely be cheaper than those produced in the EU. Requiring EU importers to make CBAM payments brings the total price of non-EU goods closer with those produced inside the EU.

Let's learn more about the intricacies of CBAM below.

The European Commission wants to make sure that EU manufacturers are not disadvantaged in the marketplace due to the burdens of tracking, reporting & paying taxes on carbon.

CBAM helps ensure a level playing field – by requiring that importers pay a carbon price for goods manufactured in non-EU countries, if those goods don’t face carbon taxes in their country of origin, or in the case they do but they are are more favourable.

If non-EU goods don’t face carbon pricing in their country of origin, they will likely be cheaper than those produced in the EU. Requiring EU importers to make CBAM payments brings the total price of non-EU goods closer with those produced inside the EU.

Let's learn more about the intricacies of CBAM below.

Did you know?

According to a study, the estimate of European welfare gain from CBAM is at $47 billion USD.

This number signifies the rise of economic gains driven by sustainable policies, highlighting how CBAM can:- Prevent carbon leakage: Ensures imported goods face similar carbon costs as EU products, keeping production local.

- Drive global emissions reductions: Encourages non-EU companies to adopt cleaner production methods.

- Support the EU Green Deal: Aligns with the EU’s goal of achieving net-zero emissions by 2050.

- Generate revenue for green investments: Funds climate adaptation and low-carbon technologies.

- Encourage transparency in supply chains: Promotes accurate reporting of carbon emissions in imports.

- Align with global climate goals: Sets a precedent for integrating climate action into trade policy.

Why do we Need EU CBAM Regulations?

- CBAM regulations help level the playing field, as far as pricing, for goods made inside and outside the EU, as discussed above.

- CBAM is also part of a suite of EU regulations that, together, are meant to curb climate change.

- The end goal of all the EU’s “Fit for 55” initiatives is to reduce greenhouse gas emissions at least 55% by 2030. CBAM is part of the Fit for 55 plan.

- If EU manufacturers source precursor materials for their production processes from suppliers outside the EU, they may be inadvertently contributing to global warming.

- CBAM for manufacturers addresses this gap and ensures that all EU manufacturing accounts for carbon emissions, regardless of their source.

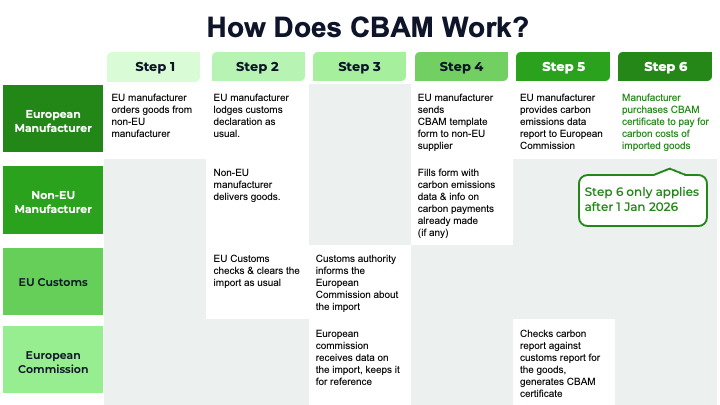

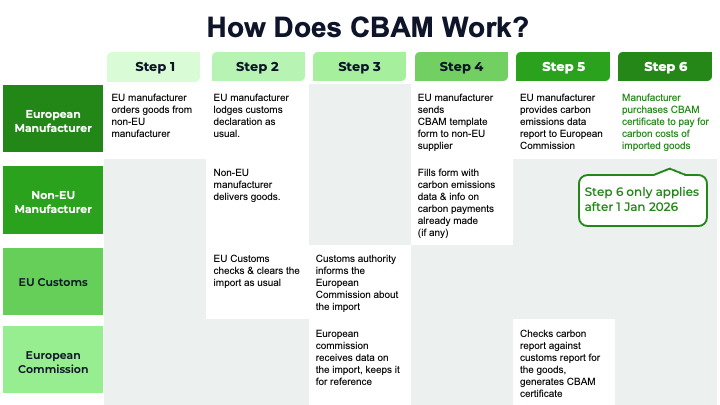

Step-by-Step Guide to the EU CBAM Reporting Process

Registering with EU Authorities

The first step for businesses subject to CBAM regulations is to register with the designated EU authorities. This registration process establishes the company’s obligation to comply with the CBAM rules. It also includes regular reporting and verification of emissions data. Registration requires providing details about the company’s operations, types of goods imported, and estimated carbon emissions. This step is crucial for companies to legally continue their trade with the EU under the CBAM framework.Document Emissions

During the transitional period of the EU's CBAM, which started on October 1, 2023, importers are required to regularly report the embedded emissions of the specified goods they import. While the initial reporting is crucial during the first quarter to establish compliance, reporting continues throughout the transitional period until December 31, 2025.Engage With Suppliers

To ensure accurate emission data, businesses must collaborate with suppliers, such as producers or exporters of these goods.Apply for AEO Authorization

Importers must obtain authorised CBAM declarant status before bringing CBAM-covered goods into the EU.

Use Estimated Values

During the transitional phase, the Implementing Regulation permits using estimated values to calculate embedded emissions.Submit CBAM Reports

Importers need to submit CBAM reports for goods that have undergone inward processing and are then released for free circulation.CBAM Scope

The CBAM targets imports of carbon-intensive goods at risk of carbon leakage, including cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen.Who Needs to Be an Authorised CBAM Declarant?

To be approved by the European Commission’s competent authority, applicant companies must:- Have no serious infringements related to customs legislation, taxation rules, or market abuse regulations.

- Show financial and operational capability to comply with CBAM reporting and obligations under the EU Commission trading system.

- Be established in the country of origin where the application is submitted.

- Hold a valid Economic Operators Registration and Identification (EORI) number.

Fact Check

- Starting January 1, 2026, only CBAM declarants can handle CBAM imports into the EU. Importers of CBAM goods must apply for this status from December 31, 2024.

- During the transitional period until December 31, 2025, indirect custom representatives can be used as substitutes for CBAM declarants.

Reporting Requirements for CBAM

CBAM reporting involves submitting comprehensive data about the carbon footprint of imported products. This includes:- Direct Emissions: Carbon emissions directly associated with the production process, such as those from energy consumption and manufacturing activities.

- Indirect Emissions: In some cases, CBAM reporting may require details about emissions from the supply chain, including transportation and raw material extraction.

- Verification of Data: All reported data must be verified by accredited third-party auditors to ensure accuracy. This verification process is a key part of maintaining transparency and credibility in the CBAM framework.

- Quarterly Reporting: Importers must submit a CBAM report to the European Commission every quarter, due within a month of each quarter’s end. The first reporting deadline is January 31, 2024, for Q4 2023.

- Registration: Importers need to register in the CBAM Transitional Registry, accessible through the CBAM Portal for compliance and reporting.

- Greenhouse Gas Emissions (GHG): Importers must disclose GHG emissions embedded in imports, covering both direct and indirect emissions, based on the specific product type.

- Per-Product and Per-Installation Basis: Detailed data is required, reported on a per-product and per-production installation basis.

- Actual Emissions: From Q3 2024, importers must switch to reporting actual embedded emissions instead of relying on default values.

Penalties for Non-Compliance of CBAM Regulations

- Non-compliance with CBAM reporting requirements or submitting inaccurate reports can lead to penalties imposed by individual EU member states, ranging from €10 to €50 per ton of emissions that are either unreported or inaccurately reported.

- Starting in 2027, authorised CBAM declarants who fail to submit the required number of CBAM certificates by the annual deadline of May 31 will face penalties equivalent to those under the EU Emission Trading System (ETS), amounting to €100 for each ton of CO₂ not properly accounted for.

Financial Implications of CBAM Reporting for Businesses

Understanding the Cost of Non-Compliance

Non-compliance with CBAM regulations can lead to substantial financial penalties. These penalties may include fines for late submissions, additional tariffs, or the loss of market access within the EU. The financial burden of non-compliance can significantly impact on a company’s bottom line and reputation in the market. For businesses that rely heavily on exports to the EU, the stakes are particularly high.Budgeting for CBAM Reporting Software

Investing in CBAM reporting software is not just a cost but a strategic decision that can yield long-term savings. By automating reporting tasks, companies can reduce labour costs and the risk of errors that may result in costly penalties. Additionally, advanced software can provide insights that help companies optimise their carbon footprint, potentially reducing the number of CBAM certificates they need to purchase.The Long-term Benefits of Accurate CBAM Reporting

Accurate CBAM reporting has long-term benefits beyond avoiding penalties. It can improve a company’s reputation as a leader in sustainability, attract environmentally conscious clients, and strengthen relationships with stakeholders. Moreover, companies that excel in CBAM compliance are better positioned to adapt to future regulatory changes, maintaining a competitive edge in the market.Challenges While Implementing CBAM

Implementing the EU's Carbon Border Adjustment Mechanism (CBAM) presents several challenges, particularly regarding its alignment with global trade rules.- World Trade Organisation (WTO) Compatibility: CBAM may face challenges aligning with WTO's non-discrimination principles, raising concerns about unequal treatment of imports.

- Risk of Trade Disputes: Differences in carbon pricing could lead to trade tensions, especially with countries where production costs rise due to CBAM.

- Impact on Developing Nations: Developing countries may struggle with the financial burden of carbon compliance, affecting their trade with the EU.

- Carbon Leakage Risks: CBAM aims to prevent carbon leakage but may inadvertently drive industries to less-regulated regions.

- Administrative Complexity: Managing the reporting and compliance for imported goods poses significant administrative challenges.

List of CBAM Goods

Here is a list of CBAM Goods:- Cement

- Iron

- Steel

- Aluminum

- Fertilizers

- Hydrogen

- Electricity

- The European Commission provides a comprehensive listing of all CBAM goods in the CBAM Guidance

Role of CBAM Software in Streamlining Reporting

Many businesses struggle with the manual efforts required to compile data across multiple locations, making the reporting process time-consuming and prone to errors. This is where CBAM software becomes invaluable. With features like automated data collection, verification tools, and seamless integration with other systems, CBAM software significantly reduces the burden of compliance.How to Choose the Best CBAM Software

Selecting the right CBAM reporting software is crucial for companies aiming to ensure compliance and efficiency. Here are a few key factors to consider:- Automation Capabilities: Look for software that automates data collection and analysis, reducing the need for manual intervention.

- Scalability: Focus on scale with respect to business supply chain complexity e.g. large amount of suppliers

- Integration with Existing Systems: Effective CBAM software should integrate seamlessly with your current ERP and carbon accounting tools.

- User-Friendly Interface: A straightforward user interface can make a big difference in onboarding teams and managing data.

CBAM Policies and Laws

- CBAM Reporting Requirements: Under the new rules, importers must use CBAM reporting software to report verified greenhouse gas (GHG) emissions embedded in imported goods for each calendar year.

- Impact After Transitional Period: Following the transitional period ending in 2025, CBAM costs will gradually phase in until 2034, increasing the financial impact.

- Deducting Carbon Costs: Importers can deduct carbon costs paid in the country of origin from their CBAM charges, if properly documented.

- CBAM Certificates: Payment of charges requires the purchase and surrender of CBAM certificates, linked to EU ETS allowance prices.

- Compliance Maintenance: Importers must ensure their CBAM registry holds certificates covering at least 80% of emissions during the year, along with submitting an annual declaration.

CBAM Timeline: What do I have to do Now?

The EU CBAM Timeline is simple: CBAM Timeline: Transitional Period:- 1 October 2023 – 31 December 2025

- Incremental Rollout: 1 Jan 2026 – 31 Dec 2033

- Full Implementation: 1 Jan 2034 & beyond

Transitional Period

- During the Transitional Period of 1 October 2023 – 31 December 2025, importers of CBAM goods will be responsible only for the reporting of carbon emissions from imported goods.

- No payments for imported goods’ carbon emissions will be required during this time. The transitional period is meant to help EU manufacturers understand the new systems for tracking & reporting on imported goods’ carbon emissions.

- This period will also help the European Commission and customs offices implement tracking and document management processes.

- It will also help the European Commission understand carbon pricing systems in non-EU countries, as well as embedded carbon levels involved with different imported goods.

Definitive Period- Incremental Rollout

- From 1 January 2026, CBAM payments will be required for some imported goods.

- Throughout the period 1 Jan 2026 – 31 Dec 2033, the set of goods for which CBAM payments are required will gradually expand.

- For a full timeline of this incremental rollout, consult the CBAM Guidance materials from the European Commission.

Definitive Period - Full Implementation

From 1 Jan 2034, all CBAM Goods will require both reporting & CBAM payments.Wrapping Up

The EU’s Carbon Border Adjustment Mechanism (CBAM) marks a pivotal shift in global trade, pushing businesses to align with stricter carbon accountability. While navigating new regulations and ensuring accurate reporting can be challenging, it also offers a chance for companies to become sustainability leaders. By effectively adapting to CBAM requirements, businesses can streamline compliance, reduce risks, and stay competitive. CBAM is more than a regulation—it’s a catalyst for change towards a low-carbon economy. By embracing it, companies can turn compliance into a strategic advantage in an evolving market.Frequently Asked Questions

1. What is the main purpose of CBAM?

CBAM aims to prevent carbon leakage by placing a carbon price on imports into the EU, ensuring that imported goods face the same carbon costs as those produced within the EU. This helps the EU meet its climate targets while encouraging global trade partners to adopt more sustainable practices.2. How does CBAM reporting differ from traditional carbon reporting?

While traditional carbon reporting focuses on a company’s own emissions, CBAM reporting specifically targets the carbon footprint of imported goods, requiring businesses to track and disclose the emissions associated with their products' production outside the EU.3. What penalties can my business face for failing to comply with CBAM?

Non-compliance with CBAM regulations can lead to fines, additional tariffs on imports, and even restrictions on accessing the EU market. These penalties can significantly impact your business's profitability and market reach.4. How can Mavarick's CBAM software help with compliance?

Mavarick's software automates the data collection and reporting process, integrates with existing systems, provides real-time compliance tracking, and supports third-party verification, making CBAM compliance more manageable and accurate.5. Which industries are most affected by the 2024 CBAM regulations?

The 2024 CBAM regulations primarily affect industries like steel, aluminium, cement, fertilisers, electricity, and have expanded to include certain chemicals and polymers. Any business importing high-carbon goods into the EU should be prepared to comply.Carbon Accounting System

Carbon Emissions Reporting for the Supply Chain

- Visible Supply Chain

- Quality Data You can Trust

- Auditable Reports